Many of us know the debt that comes along with undergraduate degrees. Some of you may still be paying yours down. But what about graduate degrees? A recent article from the Wall Street Journal examined the discrepancies between debt incurred in 2015–16 and the income earned two years later.

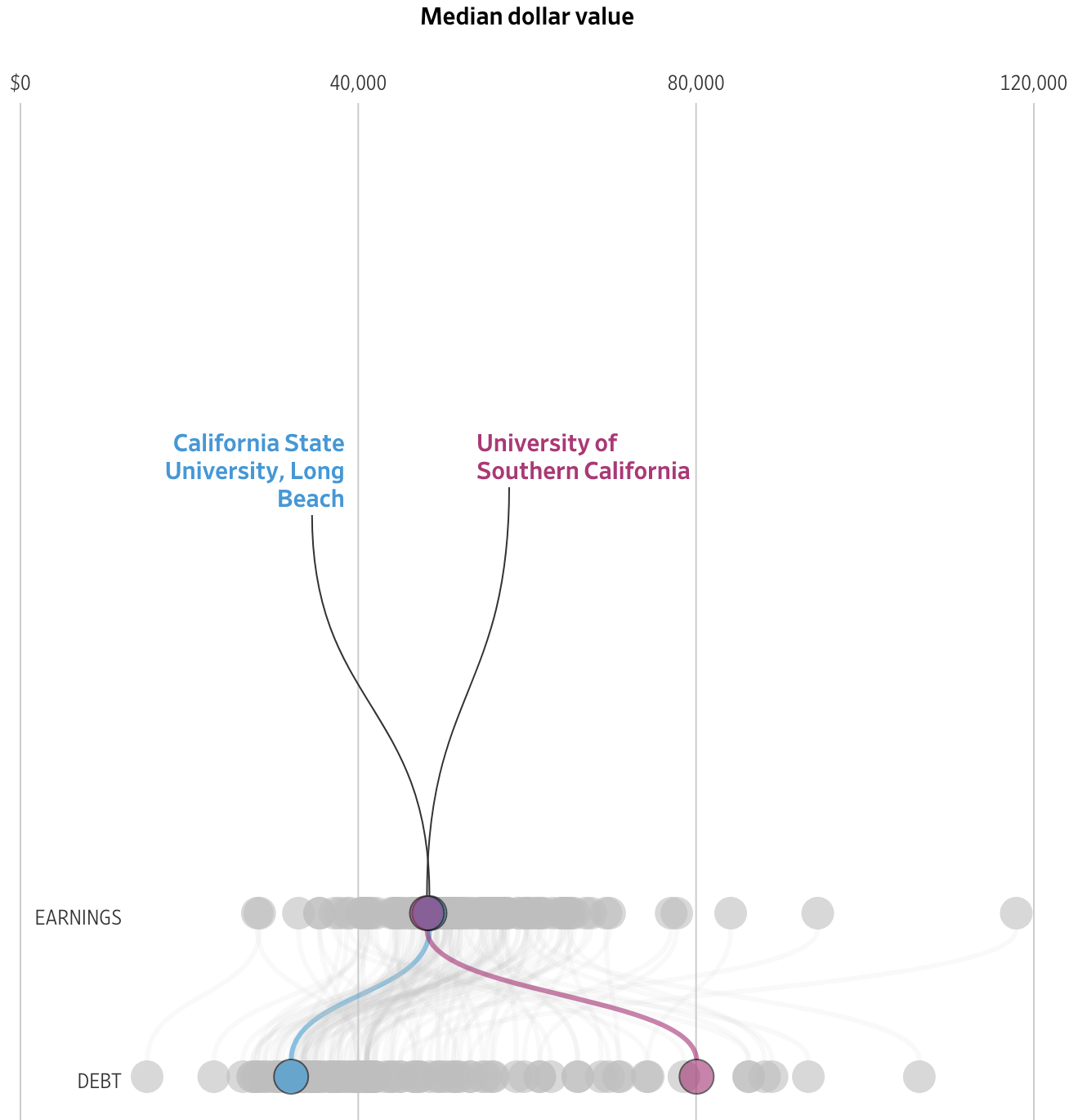

The designers used dot plots for their comparisons, which narratively reveal themselves through a scrolling story. The author focuses on the differences between the University of Southern California and California State University, Long Beach. This screenshot captures the differences between the two in both debt and income.

Some simple colour choices guide the reader through the article and their consistent use makes it easy for the reader to visually compare the schools.

From a content standpoint, these two series, income and debt, can be combined to create an income to debt ratio. Simply put, does the degree pay for itself?

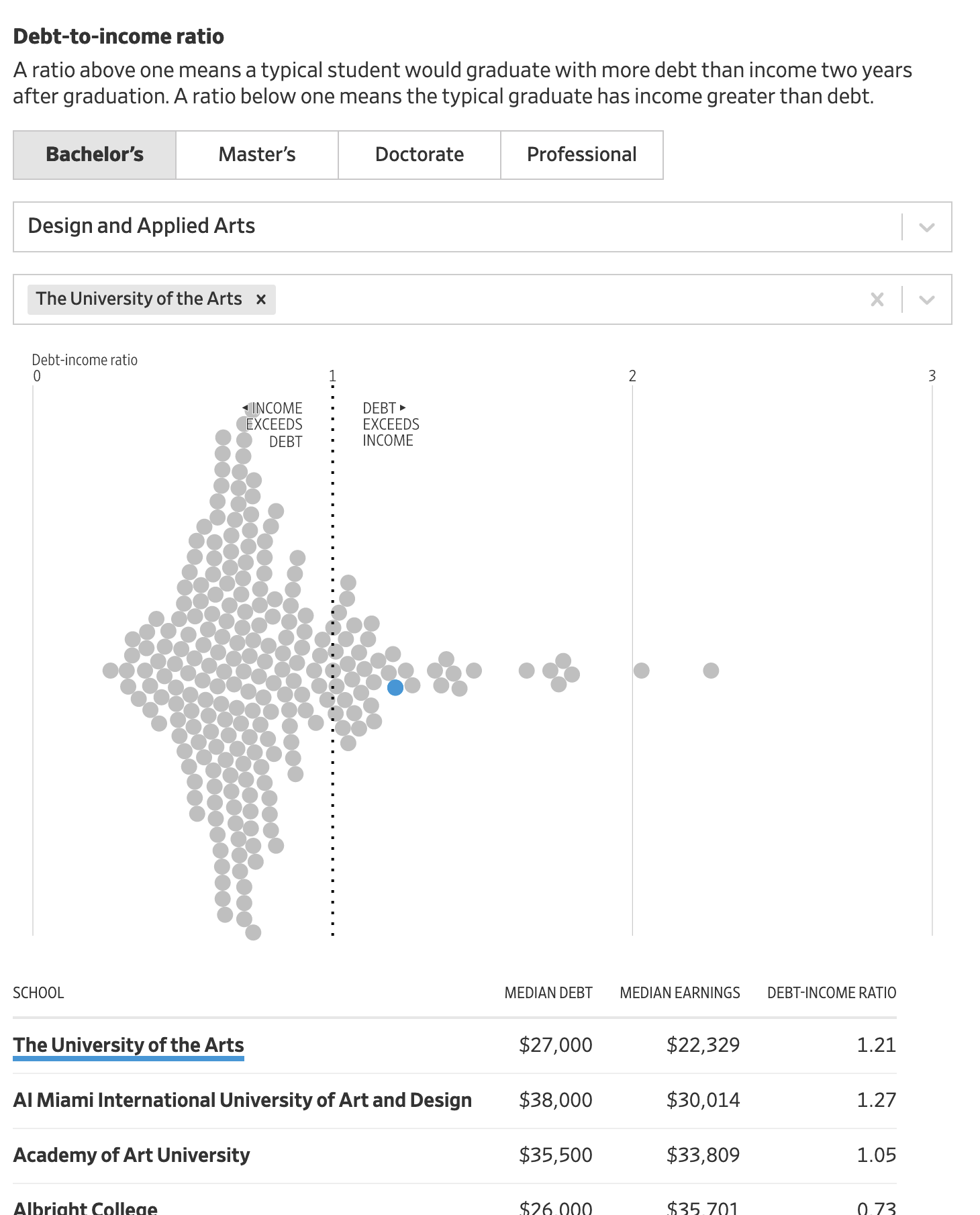

What’s really nice from a personal standpoint is that the end of the article features an exploratory tool that allows the user to search the data set for schools of interest. More than just that, they don’t limit that tool to just graduate degrees. You can search for undergraduate degrees.

Below the dot plot you also have a table that provides the exact data points, instead of cluttering up the visual design with that level of information. And when you search for a specific school through the filtering mechanism, you can see that school highlighted in the dot plot and brought to the top of the table.

Fortunately my alma mater is included in the data set.

Unfortunately you can see that the data suggests that graduates with design and applied arts degrees earn less (as a median) than they spend to obtain the degree. That’s not ideal.

Overall this was a really nice, solid piece. And probably speaks to the discussions we need to have more broadly about post-secondary education in the United States. But that’s for another post.

Credit for the piece goes to James Benedict, Andrea Fuller, and Lindsay Huth.