Today will be an unusual day in that it shall have two posts. This first post is following up on yesterday’s about the 47% of Americans who do not pay federal income tax. The Earned Income Tax Credit was created to incentivise people to work. A tax on your income, after all, does the opposite. Why make more money when you pay more of it to the government? By not taxing the poorest Americans, you remove that pressure and instead push the poor towards working for the things they can now purchase. And in so doing, one reduces the level of poverty as those who were poor slowly pull themselves up by their cliched bootstraps.

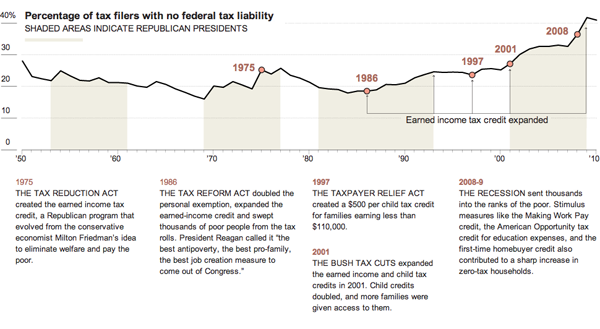

This is not a liberal idea. One of the earliest proponents of the idea behind the Earned Income Tax Credit programme was none other than Milton Friedman whose laissez-faire economic policies can hardly be called in line with the Democratic platform. And as the following timeline from the New York Times illustrates, the expansion of tax credits like the EITC have generally been largest under Republican administrations.

Consequently, the implication in Governor Romney’s dinner that the growth has been Democratic is incorrect. In fact, much of the growth behind this “taker” society can be attributed to Republican policies in previous administrations. We should debate whether Friedman-like policies, but we shouldn’t accept candidates’ placement of blame when it is so broadly applied.

Tax policy is an important part of a nation’s fiscal and economic health. We should have these debates. But we should have these debates understanding the facts. Not false “facts”. Not opinionated “facts”. Not invented “facts”. We should hold our candidates to arguing with the facts. Campaigns need not be driven by facts. Campaigns can be driven by broader narratives. But when policies and platforms are scrutinised, they should hold up to the facts.